BAS Agent vs Bookkeeper

You may be thinking… what’s the difference?

Firstly, not all Bookkeepers need to become BAS Agents! A bookkeeper can also be a BAS Agent! However, if a business requires a contract Bookkeeper to provide a BAS service, they must be a registered BAS Agent. It is only a BAS Agent that can interact with the ATO and your obligations to the ATO, on your behalf, unless they are your employee.

A registered BAS Agent must have the required qualifications and experience as outlined in the Tax Agent Services Regulations 2009 (TASR). Refer to the Tax Practitioners Board (TPB).

A Bookkeeper and BAS Agent play an integral part in any business. They are engaged with an expectation to keep or assist in keeping accurate and up to date financial records for every month, quarter, and at the end of the financial year.

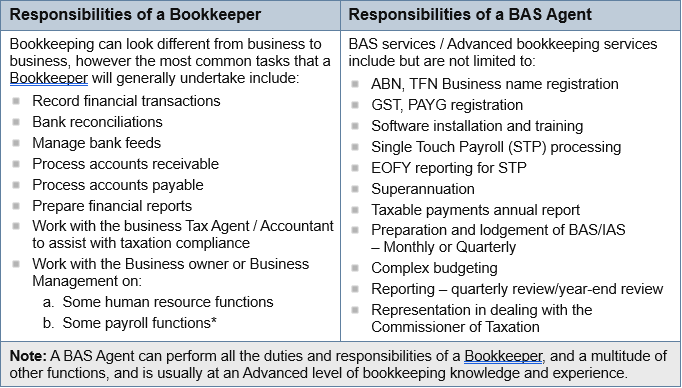

However, it is imperative to note there is a distinct line between the two roles and responsibilities as detailed below.

Contracted Bookkeepers providing BAS services for a fee, must be registered BAS Agents. Additionally, undertake continuing professional education programs throughout each year.

Summary

As a Business Owner, if you are wanting your contract Bookkeeper to complete and undertake BAS services, it is your responsibility that you engage a registered BAS Agent.

If you are unsure if your Bookkeeper is registered, please refer to the TPB website and search the register on TPB – Search the Register.

Always look for this symbol including the Agents registered BAS number.

© The Institute of Certified Bookkeepers

https://www.icb.org.au/s/Resources/BIS-BAS-Agent-vs-Bookkeeper